CANNABIS FUNDING FOR YOUR CANNA BUSINESS

$50,000 – $15 Million Funded in 24 hours – 48 hours

60 SECONDS OR LESS & IT'S FREE. Start our online application process now!

HELPING YOU GROW WITH CANNABUSINESS FUNDING

We help cannabis businesses stay ahead of the curve with the help of our remarkable resources and cannabis business funding opportunities.

360* Business Solutions

We are a full service business solutions provider.

We Innovate

We innovate systematically, continuously and successfully.

Performance

Performance is about solving problems and building business.

Why Choose CANNA BUSINESS RESOURCES?

Cannabis Business Loans up to $15 million

In a market that is thriving and growing at such a rapid pace, there is a major scarcity in options available for cannabis business owners to expand, thrive and meet their full potentials. We understand the legal cannabis business and provide you with cannabis business financing to help you grow. Why look for alternative lenders? Get yourself registered and qualify for a marijuana business loans from one of the leading cannabis lenders in the industry.

What is cannabis FUNDING?

Cannabis funding is a critical component to any rapidly growing operation providing valuable medicine and consumer products to the regulated cannabis, hemp, and CBD industries. Canna Business Resources is one of the only providers of these critical lending products to cannabusinesses, with more than $100 million extended to borrowers in the U.S. in 2021. Weather you need a small business loan or more substantial cannabis business financing, we can help.

How Much Can a CannaBusiness Borrow?

With Canna Business Resources, we can lend up to $15 million in cannabis loans to different types of cannabis businesses. Cannabis business funding can also be as little as $50,000 for quick working capital solutions that are critical to most operations.

OUR SERVICES

Designed for Cannabis Companies and CBD industries.

Canna Business Resources is a privately funded, specialized debt fund for the Cannabis/CBD industry offering customized financing solutions. CBR prides itself in being the only cannabis lender in the space that can lend to ALL asset classes while also providing unsecured financing. Truly a one-stop-shop for all Cannabis lending needs.

CBR can provide funding up to $15M as a bridge to an equity deal or a just general working capital facility. Our strategy is based upon years of working with cannabis companies that are constrained by traditional commercial institutions or simply do not have access.

Working Capital Loans

CBR is one of the only lenders in the cannabis industry to provide fully uncollateralized working capital financing to licensed operators and ancillary companies. These financings are term fundings that are customized to the needs of the borrower. Even start you own cbd business with our cannabis business loans.

Cannabis Equipment Financing

More cannabusiness companies are expanding their operations to meet the growing patient and consumer need in every regulated market. New Cannabis Equipment acquisitions and the ability to leverage existing equipment is critical to both growth and efficiency gains, and Canna Business Resources provides some of the most competitive financing options in the market. CBR also provides CBD business loans to boost startup to purchase equipment.

Commercial Cannabis Real Estate Financing

The cannabis real estate industry is rapidly evolving and CBR is increasingly providing very effective financing solutions to operators looking to acquire an asset or complete a construction project. All commercial cannabis real estate loans related with cannabis can be done through CBD business loans and cannabis funding.

AR/Invoice Line of Credit

Rapid industry growth and lack of capital support from traditional banks and lenders has created a working capital crunch throughout the vertical supply chain. CBR can provide A/R and reverse A/R invoice financing on a revolver basis. Cannabis business funding from CBR can help you grow in an evolving niche.

TESTIMONIALS

Our goal is to pioneer and provide all of the essential resources to help cannabusinesses and CBD industries thrive.

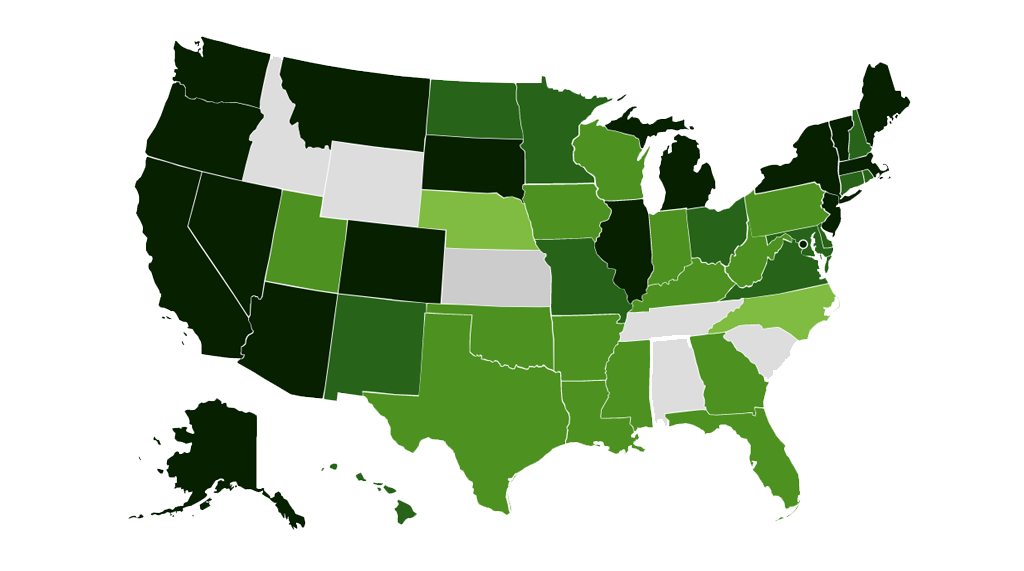

Cannabis Legality Map

Legalized

Medical & Decriminalized

Medical

Decriminalized

Fully illegal