Now’s The Time to Open Your Cannabis Dispensary

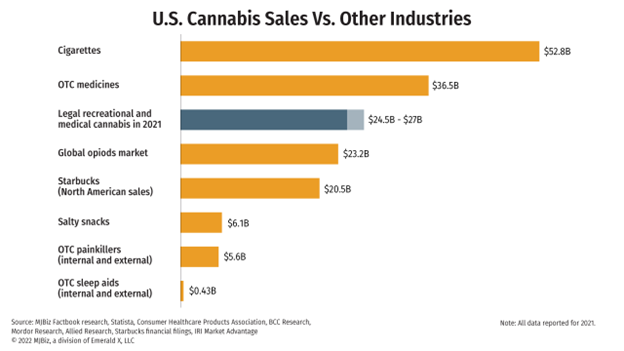

In just a fraction of time, the popularity graph of cannabis has risen too high, and this is all because of its unavoidable impacts in the therapeutic industry. It’s high time to invest and bound your share in the ever-booming business field. There are multiple options of businesses available, and here we are focusing on how to open a cannabis dispensary.

Almost in more than 33 states in the U.S., the use of cannabis is legal for medicinal purposes, while 25% of the states allow recreational use. Canada has diminished the prohibition and legalized recreational marijuana on a federal level.

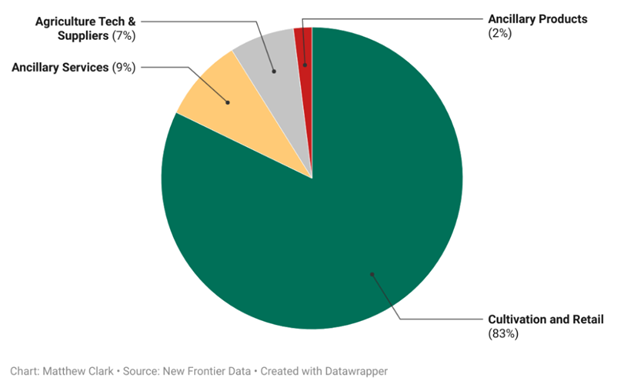

Business opportunities spring up in the cannabis industry from cultivation to processing, manufacturing to trading; everything goes hand-to-hand.

The marijuana industry is in its starting stages, and there is a long way to go, so entering the cannabis industry will be amazingly profitable. Opening a cannabis dispensary requires so much time, research, and estimation to streamline the process.

Here we will talk about the complete steps-based guide to learn how to open a cannabis dispensary, including everything from making a plan to register your business and from initial funds to making the sales live. Let’s get started!

How to Open Your Cannabis Dispensary

- Research the Risks and Eligibility Factors

Although the states have legalized cannabis and laws are less stringent than in the past, there is so much to take care of as marijuana is illegal at the federal level. Under the federally controlled substance Act, marijuana is categorized as a schedule 1 drug that can only be suggested, not prescribed.

The legal risks to dispensary business are still complex to know how to stay within standard parameters. Talking to a legal counsel will help to project all the related risks and permits.

Furthermore, keeping the financial risks in mind will make things a bit more clear. To embark on a business demands a good plan of financing it. When it comes to a cannabis venture, there are some additional expenses and other considerable challenges to find substantial funding.

Most of the banks operate under federal laws, and they even don’t allow the transact business through the traditional medium.

Then comes the need to check your eligibility. The local government has a list to check your eligibility as a dispensary owner. Such as some must-haves are:

-

- No history of any felony convictions for owner, investors, and license holders

- The dispensary must be located 500-1000 ft far from restricted locations.

- A detailed business plan encompasses each and everything.

- Agreeing and following all safety regulations.

Besides, many other eligibility-check criteria are varying from state to state.

- Research Policies, Legitimacy, Registration, and Cost

Decided to open a cannabis dispensary? Now invest your time in some research work and find the answers to your queries regarding legality and licensing.

Cannabis rules vary from state to state; even the two neighboring states have two different sets of laws, and the same goes for dispensary business. So, looking at the rules, the legal status around the dispensary location, and the sentences in violation of laws will help the entrepreneur make broad decisions.

Licensing is essential for the cannabis business, especially so pay heed to paperwork, and it all depends on the area where your business is residing. Some general must-haves include seller permits, cannabis duration licenses, and cannabis dispensary licenses.

Also, make sure that the registered and running company are both the same; otherwise, you won’t be able to operate your business lawfully in most states.

The states provide the solution to this, and you can register your business with the actual name using the “Doing Business As” certificate.

Your business insurance is vital to protect your investment in case of any unfortunate incident.

Protect your business assets using the appropriate plan by the insurance companies.

As medical cannabis is listed as the schedule 1 drug, it is not shielded by FDA tax exemptions, and the product will be asked to be issued a state tax.

After being familiar with risk factors and legal requirements to start the cannabis dispensary, now is the high time to jump into the actual business of “knowing cannabis.” You can’t succeed in a business without knowing every bit of it, from business requirements to product information.

Start educating yourself on various forms of cannabis, your audience, and how your product will best fall to their needs. It would help if you were trained to guide your customers and present the product to them in the best possible manner.

When you earn customer trust by suggesting the right product that works for them, you add days to your business life. Demonstrate your knowledge of the plant that helps your customer base.

Enrolling in a cannabis dispensary course will be a great idea to help you educate yourself and your team to perform professionally.

- Prepare a Detailed Business Plan

Documenting your business plan helps you achieve your business goal in a better way. After a good research, the entrepreneurs who make a business plan are more likely to achieve your high business goals. Your business plan must include:

-

- An executive summary

- An industry overview

- Market analysis

- Sales and marketing plan.

- Competitive analysis

- Management, Operating, and Financial plan

- Appendices and Proofs

Making a comprehensive plan will help you throughout your business journey and prove to the lender that you are serious about the next steps.

- Look up for Cannabis Dispensary Loans

Looking for a cannabis dispensary loans is another struggling task and the real pain in the stomach. Why? Because marijuana is still under illegal status at the federal level, it becomes an obstacle for applying the loans for different cannabis businesses.

The expenses to open a cannabis dispensary will depend on the location your business is residing at. If you are facing hard to find the investor for your cannabis dispensary doesn’t fret, there are still other ways you can rely on. Traditional banking is not for your marijuana business because of federal restrictions.

The cannabis market is booming, and for your cannabis business, you can consider the option of equity funding that means raising capital through the sale of shares of your business.

Furthermore, another option to consider is debt funding, where business cost is funded by debt. Personal loans are a good choice that helps to bear the startup costs if you have a good credit score and consecutive income. Also, business credit cards can be utilized to cover any emergency, pay recurring expenses, or finance startup costs.

A professional and trained team is the backbone of any business and vital for running a successful dispensary. So building a team that understands your motto, moves forward together, and takes business its own is a real success for the entrepreneur. When building a team, you need to consider two types of members.

-

- Professional support that works behind the scenes

- Day-to-day staff

If both are working as per your expectations and meeting the business needs, you will experience a sudden spike in your business success.

- Secure a Perfect Location

When you have finalized and streamlined most of the things now, it’s time to secure a perfect location for the cannabis dispensary. The regulations and compliance codes for most the cannabis related-things vary from state to state.

When finalizing the location, you must prefer the place that is accessible to potential customers. You may have to choose from the two popular options renting or buying. Most entrepreneur in the cannabis industry prefers renting instead of buying because of the ever-changing rules in the marijuana industry. So, there can be a change in the status of property-compliance for the marijuana business.

Even then, you find a compliant property; your landlord might not be supportive of the cannabis business. So, you have to look into all the obstacles in this concern and open up to the landlord to make things more transparent.

Further, you can consult real-estate agencies and brokers to help you find a cannabis-compliant corporate place.

- Branding and Marketing your Cannabis Dispensary

You can’t build up a business empire without proper branding and marketing techniques. The cannabis industry has paved its way from a black market to mainstream medical needs. What played a significant role in it? A positive branding strategy.

To make your business a brand:

-

- Pay heed to the branding and of your cannabis dispensary business.

- Follow the trends, such as choose the catchy and most-relevant logo for your business.

- Consider the cannabis-themed website designing.

- Be concerned with the interior and exterior design of the dispensary.

- The product packaging should be of high-quality and everything that is going to present your brand.

So, spend some extra time to think and decide all these things as these things turn into the real ambassadors of your business in the future and keep the loyal customers intact.

Marketing strategy is another talk of the town for the cannabis business but keeping the advertising regulations into consideration is also essential. Many marketing platforms wholly or partially ban cannabis advertisements due to the illegal status at the federal level.

So, you have streamlined everything till now. Now it’s time to open your doors for your customers. One of the best initial marketing strategies is to open up your business by hosting a grand inauguration ceremony. The main focus of this type of opening should be:

-

- Meet and introduce your team

- Provide Patient Education to your audience

- Present Product Information

- Sales & Special Discounts

The opening ceremony is your business’ first impression that must be long-lasting. This is high time to win loyal potential customers.

How Much Does it Cost to Open a Dispensary?

When it comes to opening a dispensary, it will not be cheap. Along with the building, supplies, staff, and other overhead, cannabis businesses will need to deal with application fees and licensing fees for their businesses. And based off of different state regulations, it could cost more in different states. If you plan on opening a cannabis dispensary, chances are you will need to look for cannabis loans or other financing options.

Cannabis Dispensary Loans with CBR

Jumping into the cannabis business will be proved a foresighted decision at this time where the canna industry is rapidly growing. If you have decided to take your share from so many available marijuana business options, doing your homework and making a proper strategy will be a “ball in your court” situation in the long term.

A dispensary will let your business instinct rise in what is soon to be a cumbersome, global industry. The answer to how to open a cannabis dispensary is better to rely on the step-by-step preparation for your business.

The laws are stringent for every step of opening a cannabis dispensary as federally controlled substance status still exists; however, there is still a chance to induce your business empire under these strict rules.

If you are ready to move forward on your business plan, we could love to work with you and help get you going. Our cannabis dispensary loans are a great asset for cannabis businesses and can really push you to the next level. Contact us today to learn more.